Once, I heard that Vision should be defined and written so that it could be called Vision and not just a dream. Before investing or going to investment, we need to make sure that we have defined our vision and Life Goals.

There are different types of life goals that we can make, examples as mention below:

- Wealth

- Home and Family

- Health

- Self-Improvement

- Philanthropy (Generosity)

Having merely a financial plan is not enough, you need to prioritize your plans. Which should come first? House Fund or the Education Fund of your kids? Your car? Or your vacation?

You need to prioritize each and every goals that you have so that you will be able to know which is the most important and which is the least important.

Remember Habakkuk 2:2

Then the LORD replied: “Write down the revelation and make it plain on tablets so that a herald may run with it.

Another thing that you need to do is to put a present money value to each of your goals. The target time frame, time that you can execute your goals, shall also be defined. The time is important because it will tell you the future value of your dream using the compounded formula and taking into consideration the inflation (How the value of money depreciate over time).

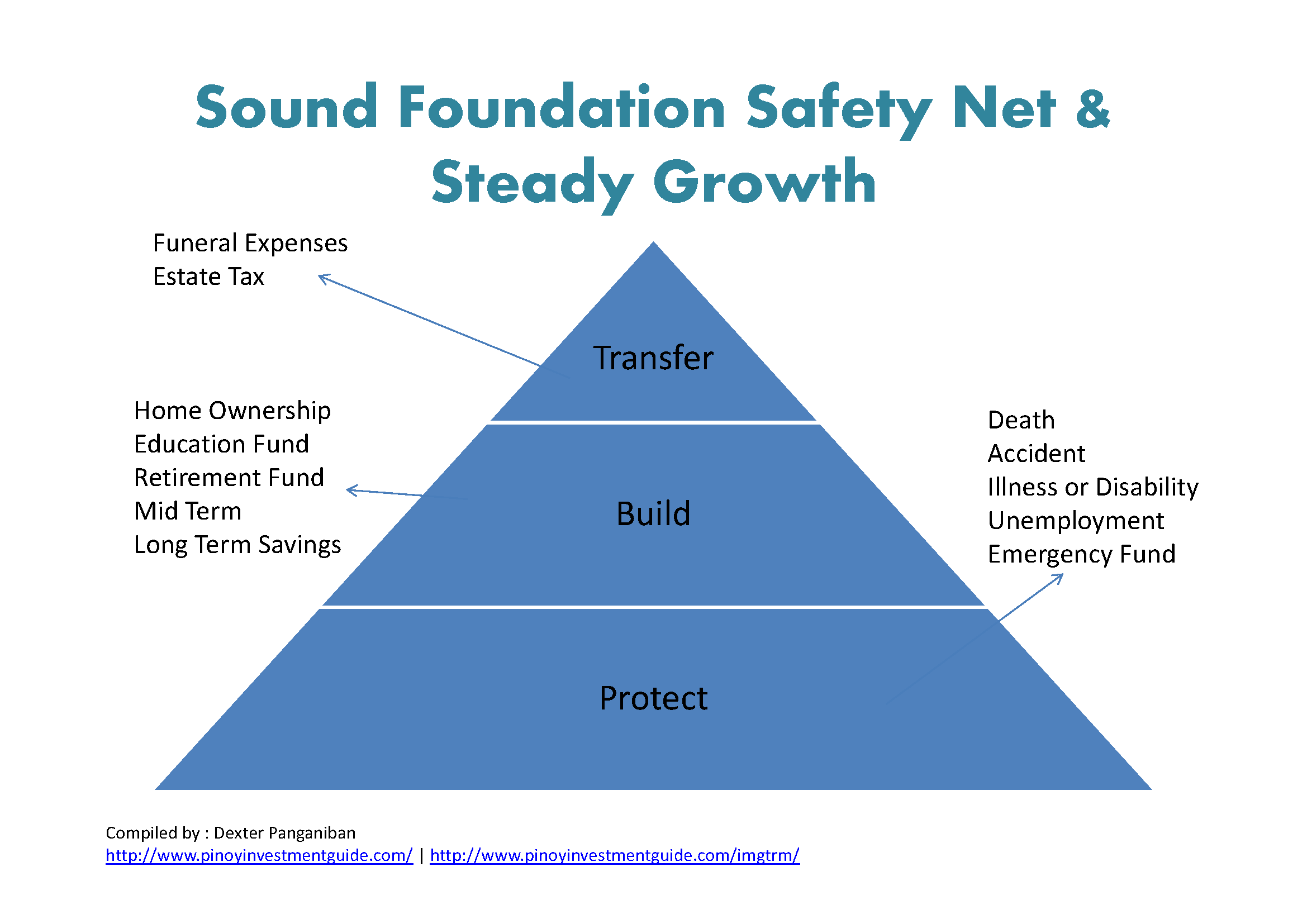

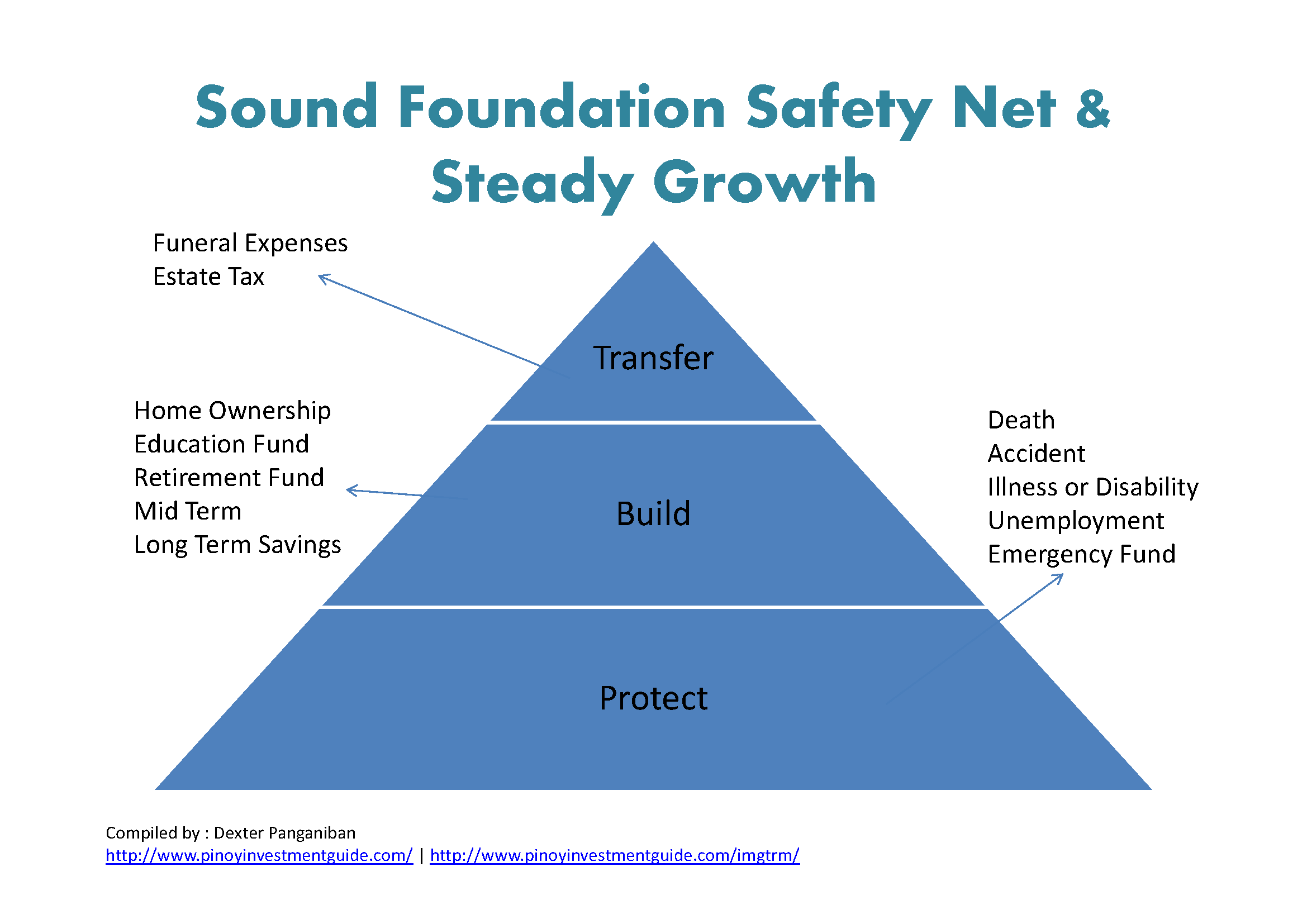

While planning for your future, you need to have a sound foundation and steady growth for your finances.

Life stages are categorized into three steps:

- Protect

- Build

- Transfer

Protection means having an Emergency Fund which is equal to 3 – 6 of your monthly expenses (Very Liquid). Getting an Insurance and Long term Health Care is also suggested. We also need to secure the risk of having a Critical Illness and untimely debt.

Proverbs 27:12 (NLT) ”A prudent person foresees danger and takes precautions. The simpleton goes blindly on and suffers the consequences.“

On the Build Stage, You need to go into investment or even business. You can do paper investment like, stocks, mutual Funds, or even VUL (Investment + Insurance). On this stage you accumulate wealth for your future. You are preparing for your retirement age.

On the Transfer stage, you make sure that whenever you die, your family will not have any problem on getting your acquired wealth because you have not prepared for the estate tax or you were not able to make testament to where your finances goes.

More ideas about Goals in Life

- The Younger You are the cheaper it is to protect

- You need to avoid procrastination (Act now)

- Time can help you create more money

- Some might prefer BTID – Buy Term and Invest the Difference

Our goals should be SMART.

- Specific

- Measurable

- Attainable

- Realistic

- Time Bound

Bible Concepts in Investing and Life Goals

But in everything we plan we need to understand the concept of the bible.

But Jesus also said “Do not store up for yourselves treasures on earth, where moth and rust destroy, and where thieves break in and steal. But store up for yourselves treasures in heaven, where neither moth nor rust destroys, and where thieves do not break in or steal; for where your treasure is, there your heart will be also.” Matthew 6.

If you set up your goals with God in your heart, you will not have any problem for whatever happen to your investment in the future. You need to trust the Lord on what he can do for you.

We need to be wise in our investment.

Proverbs 21:20 (NIV), The wise store up choice food and olive oil, but fools gulp theirs down. Do you always buy on wants basis? Or need basis?

The Bible also teach us about Diversification. Ecclesiastes 11:1-3 ESV

Cast your bread upon the waters, for you will find it after many days. Give a portion to seven, or even to eight, for you know not what disaster may happen on earth. If the clouds are full of rain, they empty themselves on the earth, and if a tree falls to the south or to the north, in the place where the tree falls, there it will lie.

So when you study about your goals, you need also to diversify your investment portfolio.

And the most important thing is that we need to be very vigilant when it comes to temptation:

1 Timothy 6:9-10 ESV

But those who desire to be rich fall into temptation, into a snare, into many senseless and harmful desires that plunge people into ruin and destruction. For the love of money is a root of all kinds of evils. It is through this craving that some have wandered away from the faith and pierced themselves with many pangs.

We want to have a happy retirement and a good life for our family, but we should not be greedy. Remember I teach before on how to increase your giving.

Did you know that you are losing potential gain every time that you delay your investing. This is what I regret in doing 10 years ago. I just started

Did you know that you are losing potential gain every time that you delay your investing. This is what I regret in doing 10 years ago. I just started

The question mentioned in the title, is a common question from readers of this blog as well as messages from my Facebook Page and personal account.

The question mentioned in the title, is a common question from readers of this blog as well as messages from my Facebook Page and personal account.