Tags

Banks, Bible, Construction, diversified portfolio, Holdings, Industrial, Mitigating Risk, Risk, Stock Market

Ecclesiastes 11:2, clearly says that our investing should be diversified, so whatever happen to one, the other can compensate for the lost. When we do investing, a thorough study should be done in each investment that we make. Research is the main thing. All investment has it’s own risk but if we study it very well, we will be able to see that each investment has different risk. We might find a risk in a type of investment like mutual fund but it is not a risk when it comes to real state.

What a Wise Person Does

11 Invest your money in foreign trade, and one of these days you will make a profit. 2 Put your investments in several places—many places even—because you never know what kind of bad luck you are going to have in this world.

3 No matter which direction a tree falls, it will lie where it fell. When the clouds are full, it rains. 4 If you wait until the wind and the weather are just right, you will never plant anything and never harvest anything. 5 God made everything, and you can no more understand what he does than you understand how new life begins in the womb of a pregnant woman. 6 Do your planting in the morning and in the evening, too. You never know whether it will all grow well or whether one planting will do better than the other.

7 It is good to be able to enjoy the pleasant light of day. 8 Be grateful for every year you live. No matter how long you live, remember that you will be dead much longer. There is nothing at all to look forward to.

As an example doing a diversified portfolio in stock market is the best thing to do, if you want to mitigate some risk. In choosing stock, you need to choose from different sector. As an example, you might have some stock from Banks, Construction, Holdings, Industrial and more. Normally this different sectors will not perform the same. There will be gain in one sector and losses at other.

Image Credit : vineyardlifejournal.wordpress.com

Ecclesiastes 11:4 says that we should not wait, but we need to act now. Procrastination should not be performed. And Ecclesiastes 11:6 it says that you need to be constant investor. In stock market there is what we called cost averaging. So it only means that you can buy anytime, even low or high it doesn’t matter. But of course this could only be applied to Long term investors and not for traders.

We will all go to the end of our life, we need to be a happy investors and not a stressful investor. Investing aims to make our life better and not to make our life in a misery just because of stress in the stock market.

If people will just follow what was mention in Ecclesiastes and just believe that God can do everything about your plans then be at peace whatever happen to your investment. If diversification fails it only means that the whole economy is going down. So do your part share what you have learn and make people financially literate but not greedy.

Be wise and learn the ins and out of investing. The riskiest thing is when you do not know anything. Happy Investing.

Make sure to join our newsletter to be updated in this blog. Fill up those form at the side.

All who are in Financial sector as well as investor is now rejoicing after Fitch Rating upgraded Philippines to Investment Grade. The immediate effect is that blue chips stocks rose before the closing time of today’s stock market.

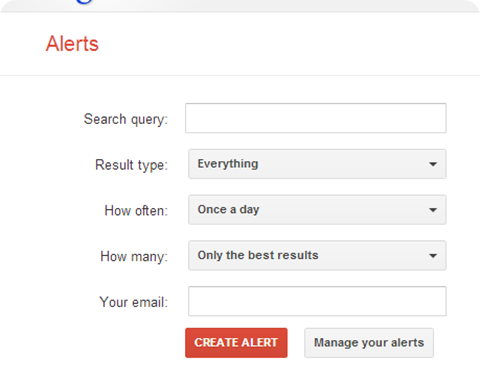

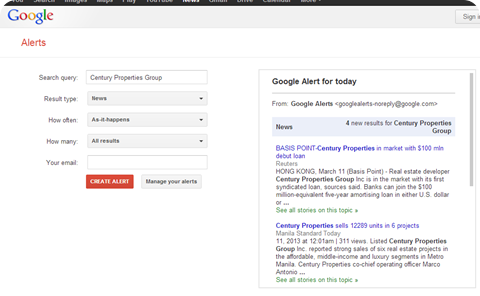

All who are in Financial sector as well as investor is now rejoicing after Fitch Rating upgraded Philippines to Investment Grade. The immediate effect is that blue chips stocks rose before the closing time of today’s stock market. Here are the procedure to start tracking news information using Google Alert:

Here are the procedure to start tracking news information using Google Alert:

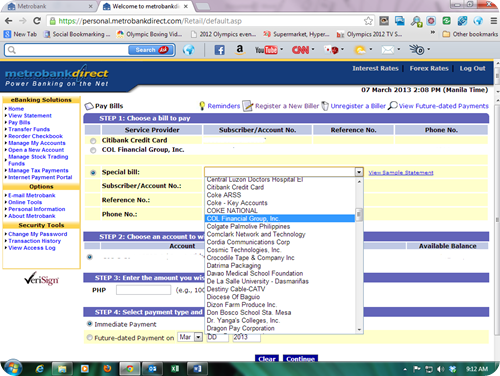

Yesterday I sent clarification to COL Financial regarding the procedure on how will the heir can get stock proceeds in case of Stock Holder’s Death and here is their reply:

Yesterday I sent clarification to COL Financial regarding the procedure on how will the heir can get stock proceeds in case of Stock Holder’s Death and here is their reply: