Yesterday I shared a Youtube video in my Facebook wall that says more and more Filipinos are now starting to invest in stock market. The post catch the attention of some of my online friends as well as relatives, which eventually started a conversation about stocks. Here are some of the questions and answer that I made during my conversation for the benefit of those who also want to learn investing in Stock Market

Yesterday I shared a Youtube video in my Facebook wall that says more and more Filipinos are now starting to invest in stock market. The post catch the attention of some of my online friends as well as relatives, which eventually started a conversation about stocks. Here are some of the questions and answer that I made during my conversation for the benefit of those who also want to learn investing in Stock Market

I have heard that investing in stock market is risky and it is like gambling? Are you now into gambling Dexter?

Well this is my answer, Stock market has two kinds, one is investing and other is trading. When you say trading, it is almost equal to gambling since, what you bought today might be sold out before the market close or could be sold by tomorrow. It is good if the market goes up, but what if the market goes down it is a sure lost. Trading is also buying speculative stocks, which means that a trader is buying a stock which does not have any history or anything to prove as a company. They just buy because of rumors that it will be high tomorrow.

I must confess that when I started stock market, I did the same because I do not know the difference of investing and trading. I do not have any mentor and I just visit some blogs and forums for information. I have not even read any book to learn first before going to stock, but as what the saying goes experience is the best teacher.

Investing is buying stocks with good market reputation, they are usually called blue chips stocks. After buying, investors tend to let their money grow for some time. It might be 1 year, 2 years, 10 years or more. If you know Warren Buffet, this is the system that he is using. He study the market buy the sticks and forget about it and he let it appreciate from time to time. Investors also earn in two ways, one is price appreciation and the other is through dividend. There are time also that investors will buy stocks and wait for his Target Price before selling his shares.

So is it Risky to Invest in Stock Market?

Actually in reality there is no safe investment. Investment will tend to gain or lost. As an investor you need to be financially literate to know what you shall behave in good times or bad times. If you cannot watch how the market moves, it would be better to go to Mutual Fund (less risk) or Equity Fund (high risk), where there is fund manager who can watch over the movement of your money. I have heard that Mutual fund performs well last year which have 30+% interest. Of course nobody knows if it will still be the same this year. Your risk appetite will definitely determine your gain. Less risk – less gain and the higher the risk – the higher the gain. I myself have 17.78% gain last year.

So how much do I need to start to Invest in Stock Market?

Good to inform that nowadays you can start at an amount of 5,000 through colfinancial.com, all my stock transaction is made through online since I am outside the country I managed to get a broker that can serve me through online. One better thing in COLFINANCIAL is their EIP system, where they will allow you to invest on a monthly or weekly or quarterly or whatever is your preferred frequency of payment with a fix amount. It is also called Peso Cost Averaging

So how did you enroll in COLFINANCIAL?

I have filled up their application form, then scan the documents and send it to Colfinancial for checking and after they have checked my details they told me to send the original documents to their Ortigas Office. After they have received the documents they send me my login details and the bank reference that I will use to start investing in the stock market.

There are still lots of Q&A that I have responded yesterday and I think I can make the other conversation in future post. So keep on sending question though the comment section so that we would be able to respond to your question. If I can’t answer the question I will try to ask some of friends to respond for us. Make Sure to provide us your email as shown in the side bar for you to be updated on our post.

Photo Credit : Flickr username 401(K) 2012

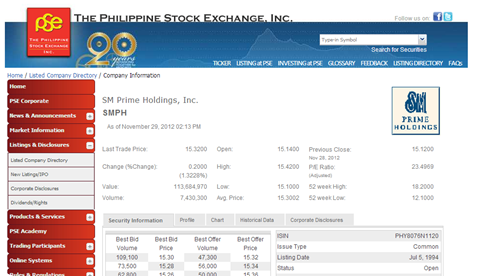

Update : Great Information from Philippine Stock Exchange on Investing Procedure ( Courtesy of The Global Filipino Investors TGFI Facebook Group)

Many think that all debt is bad and there is no good debt. Now let me just share you some thoughts on what I understood about the bad debt and the good debt.

Many think that all debt is bad and there is no good debt. Now let me just share you some thoughts on what I understood about the bad debt and the good debt. I actually do not know about the emergency funds, until such time that I have heard about this topic in you tube through ANC Money. Emergency funds is a fund that is ready at any time if the need arise. According to one of the financial adviser that was interviewed in ANC Money, emergency fund shall be at least 3 to 6 months of the monthly expenses of a single individual.

I actually do not know about the emergency funds, until such time that I have heard about this topic in you tube through ANC Money. Emergency funds is a fund that is ready at any time if the need arise. According to one of the financial adviser that was interviewed in ANC Money, emergency fund shall be at least 3 to 6 months of the monthly expenses of a single individual. This is also one of my question in life. I have been working for almost 13 years and yet there are lots of things that I need to accomplish to become a rich man. I am rich spiritually but I think financial resources should follow. Today during my reading of the Cash Flow Quadrant by Robert Kiyosaki, he mentioned that we need to start building list of assets that brings income and not expenses.

This is also one of my question in life. I have been working for almost 13 years and yet there are lots of things that I need to accomplish to become a rich man. I am rich spiritually but I think financial resources should follow. Today during my reading of the Cash Flow Quadrant by Robert Kiyosaki, he mentioned that we need to start building list of assets that brings income and not expenses.  Finding time to learn is also a type of investment. You invest your time and strength to be able to gain knowledge. This knowledge could be used to start your own business. We need to use our time wisely to get the proper information on the things that we need to learn ( I call it time management) . There are times that we are eagerly trying to learn something but we are being side track by other things on the net which make us out of focus on our main objective.

Finding time to learn is also a type of investment. You invest your time and strength to be able to gain knowledge. This knowledge could be used to start your own business. We need to use our time wisely to get the proper information on the things that we need to learn ( I call it time management) . There are times that we are eagerly trying to learn something but we are being side track by other things on the net which make us out of focus on our main objective. As an OFW working in Saudi Arabia, I have always dream of having my own business someday and escape from the corporate world. I love reading blogs and books about financial management, successful stories of other entrepreneur stories and more. I also remember watching Negosyete when I was a kid. Negosyete is a television program showcasing different businesses in the Philippines aired late 90’s. I don’t think it still exist. Now there are lots of blogs, e-books, seminars where we could attend to gain knowledge in business and investing. We only have to control the usage of our time. As for now I am engage in the following businesses:

As an OFW working in Saudi Arabia, I have always dream of having my own business someday and escape from the corporate world. I love reading blogs and books about financial management, successful stories of other entrepreneur stories and more. I also remember watching Negosyete when I was a kid. Negosyete is a television program showcasing different businesses in the Philippines aired late 90’s. I don’t think it still exist. Now there are lots of blogs, e-books, seminars where we could attend to gain knowledge in business and investing. We only have to control the usage of our time. As for now I am engage in the following businesses: